Low mortgage interest rates, healthy employment growth and a stable supply of homes created fertile ground for the Houston real estate market, which blossomed to record levels in 2019. Single-family home sales for the full year surpassed 2018’s record volume by nearly five percent. December delivered the year’s strongest percentage increase in single-family home sales. However, as 2020 gets underway, housing inventory has shrunk slightly, which could narrow options for consumers that may be hoping to buy a home in the new year.

Total dollar volume for 2019 climbed 6.7 percent to a record-breaking $30 billion. Single-family home sales for the month of December jumped 14.3 percent to compared to December 2018.

The strongest sales activity took place among homes priced between $250,000 and $500,000, which rocketed 27.2 percent. Homes in the $150,000 to $250,000 range ranked second place, climbing 13.7 percent. The luxury segment, consisting of homes priced from $750,000 and above, increased 12.7 percent. Reflecting a continuing constrained supply of entry level housing, sales decreased 20% in the $1 – $99,999: and decreased 15.8% in the 100,000 – $149,999 ranges.

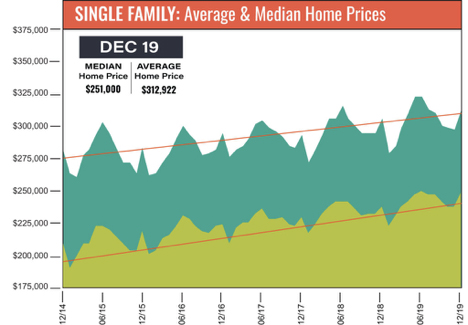

Prices of single-family homes set new December highs. The median price (the figure at which half of the homes sold for more and half sold for less) rose 4.6 percent to $251,000 while the average price went up 2.5 percent to $312,922. Despite those highs, pricing increases in general began to show moderation as the end of the year drew to a close. In early 2019, the housing supply grew almost immediately, rising from a 3.6-months supply in January to a peak of 4.3 months in June and July. Months of inventory estimates the number of months it will take to deplete current active inventory based on the prior 12 months sales activity.

On a year-to-date basis, the average price rose 2.3 percent to $305,959 while the median price increased 3.2 percent to $245,000. Total active listings, or the total number of available properties, rose 3.6 percent from December 2018 to 38,504. Single-family homes inventory narrowed slightly from a 3.5-months supply to 3.4 months. For perspective, housing inventory across the U.S. currently stands at a 3.7-months supply, according to the latest report from the National Association of Realtors (NAR).

Houston’s lease market staged a mixed performance in December. Single-family home leases rose 5.0 percent while townhome/condominium leases fell 5.5 percent. The average rent for single-family homes was flat at $1,764 and the average rent for townhomes/condominiums was up 2.7 percent to $1,569.